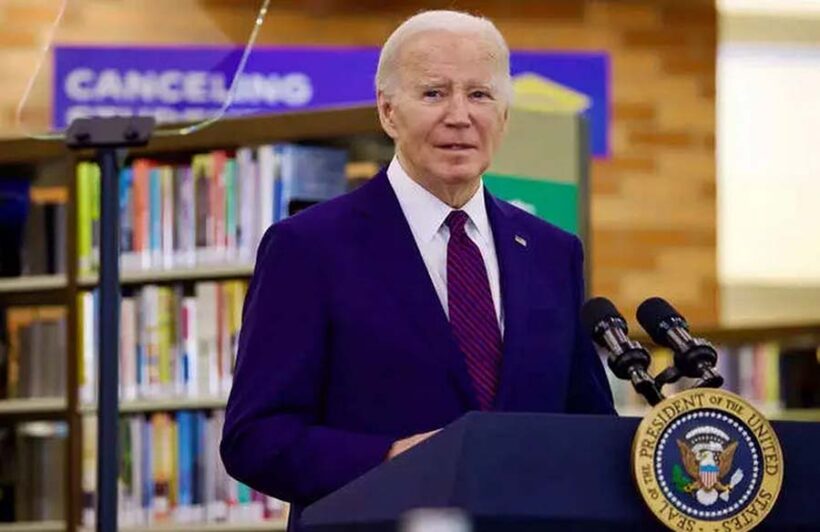

President Joe Biden’s administration is moving forward with its second attempt at student loan forgiveness, bringing federal borrowers one step closer to potential relief. Here’s a closer look at the latest developments and what borrowers can expect next.

Negotiating Relief Under the Higher Education Act

In a series of negotiation sessions held on February 22 and 23, the Education Department collaborated with stakeholders to determine eligibility criteria for debt relief under the Higher Education Act of 1965. This marked the fourth and final session in the process.

The Road to Relief

Following the Supreme Court’s rejection of Biden’s initial debt relief plan, the Education Department embarked on a new approach, engaging in negotiated rulemaking. This involved extensive negotiations and public feedback sessions to formulate a comprehensive relief strategy.

Addressing Financial Hardship

Concerns arose during the negotiation process regarding the omission of a category for borrowers experiencing financial hardship. In response, the department convened an additional session to address this issue. Discussions centered on defining hardship parameters, considering factors like household income and repayment history.

Expanding Relief Initiatives

In previous negotiation sessions, the department proposed relief measures targeting various borrower groups. These included borrowers with outstanding balances exceeding their original debt, those who entered repayment over 20 years ago without receiving relief, and individuals eligible for income-driven repayment and Public Service Loan Forgiveness.

Inclusion of Parent PLUS Loan Borrowers

A notable aspect of the relief plan is the inclusion of borrowers with parent PLUS loans, which cover educational expenses not met by other financial aid. This demographic will benefit from relief initiatives, including the new SAVE income-driven repayment plan.

The Path Forward

With the negotiation phase concluded, the Education Department will finalize the proposed relief text. This text will undergo public scrutiny through a comment period, allowing stakeholders to provide feedback. After adjustments based on public input, the department will finalize the rule for implementation by July 2025.

Separate Initiatives and Future Prospects

The second attempt at debt relief operates independently of other targeted relief efforts by the Education Department. Initiatives such as the SAVE plan, aimed at reducing undergraduate borrower payments, will continue to roll out. Additionally, recent debt cancellations and ongoing legal challenges underscore Biden’s commitment to addressing student loan burdens.

A Continuing Commitment

Despite legal obstacles, President Biden remains steadfast in his commitment to student loan forgiveness. While facing opposition, he reaffirmed his dedication to exploring alternative paths for debt relief, emphasizing the administration’s ongoing efforts to support borrowers.

As the Education Department progresses with its relief plan, borrowers can anticipate further updates and opportunities for engagement throughout the implementation process.